The Association of Dental Groups announced the launch of a report named ‘Patients First’ which describes the 7 recommendations for the Government and its implementation will transform patients’ lives in the United Kingdom. The member group consists of 10,000 clinicians and 1,800 practices that are trying for the recruitment and retention of the dental workforce and also aim to plan the workforce and protect the dental budget.

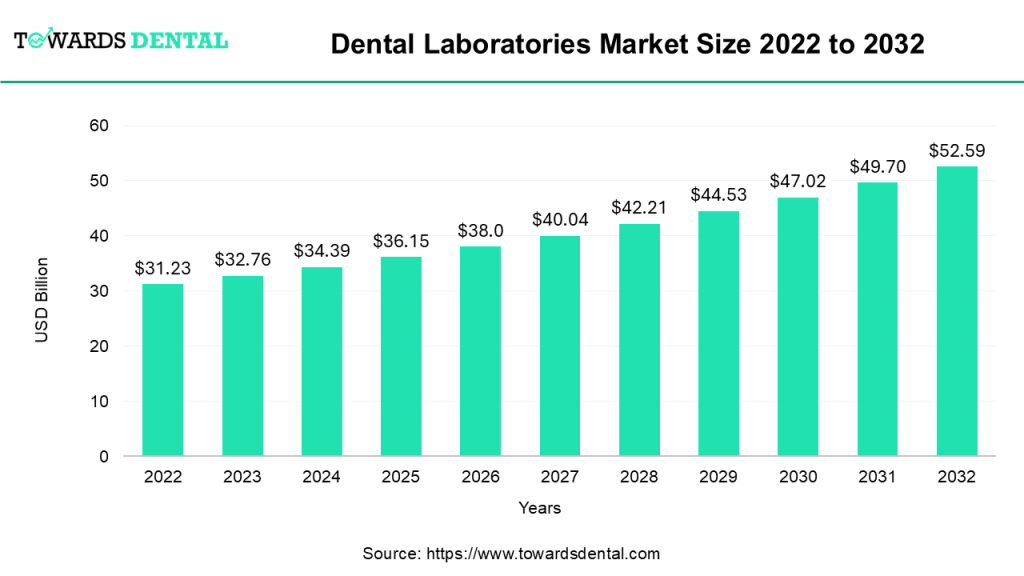

Dental Laboratories Market Size

According to Precedence Research’s Report, the global dental laboratories market size was USD 32.76 billion in 2023 and is predicted to reach around USD 52.59 billion by 2032, expanding at a CAGR of 5.40% from 2023 to 2032.

According to the National Institute of Health and the National Institute of Dental and Craniofacial Research, $34.9 billion was issued via 58,951 grant awards that supported research at 2,743 universities, small businesses, hospitals, and organizations. The institutes, centers, and offices of the NIH award 80-85% of the NIH budget to assist extramural research that is conducted outside of NIH. About 10% of the budget from NIH supports intramural scientists in NIH laboratories. The NIH consists of 27 institutes and centers along with the Office of the Director, out of which 24 provide funding opportunities and grant awards.

According to Cetas Healthcare, there are more than 700 general practitioner dentists, and above 450 offer specialty treatments in orthodontics and restorative dental treatments. There are more than 8 major dental markets across the globe. Among these, 75% of general practitioner dentists are the owners or partners of a private clinical practice while 46% of general practitioner dentists in the USA have a practice size of greater than $1 million. Every week, about 3.6 dental implant cases are performed by GP dentists and the number is 6.3 in Spain. Furthermore, 71% of general practitioner dentists rely on biomaterials for dental filling procedures. With the use of biomaterials, 93% of those dentists are highly satisfied with it.

1954-2023 Policies of the American Dental Association for Access to Dental Services

| Form of the Policy | Objectives |

| Access | The availability of dentists for American Indians and Alaska natives. |

| Public funding for oral healthcare is offered at academic dental institutions. | |

| The ADA supports increasing resources for the Department of Veterans Affairs Dental Care. | |

| The availability of dentists for Underserved populations. | |

| The evaluation and fulfillment of unmet dental needs to promote oral health by using culturally competent strategies. |

The dental laser segment is anticipated to grow at the fastest CAGR of 8.7% during the forecast period.

A research study report by Cetas Healthcare reported that the adoption of dental clinic websites by 2025 will be greater by Italy and China due to their estimated maximum growth in dental clinic websites. Additionally, other countries including the USA, Germany, France, the UK, Spain, and Brazil will show the maximum growth by the adoption of dental clinic websites by 2025 which will be greater than in 2023. There will be digitization of dental services by 2025 and top services that are expected to be digitized by 2025 include inventory management, patient feedback/ satisfaction surveys, and analytics tools to optimize clinical diagnosis.

- Dentalcorp and VideaHealth Partnered to Advance AI-powered Dental Care Across Canada - September 23, 2025

- PHFI Launched Initiative for Community-focused Oral Health Research - September 23, 2025

- A Big Change in Canadian Dental Care Plan in 2025 - September 23, 2025